Guides

Should You Buy Bitcoin or Bitcoin Miners?

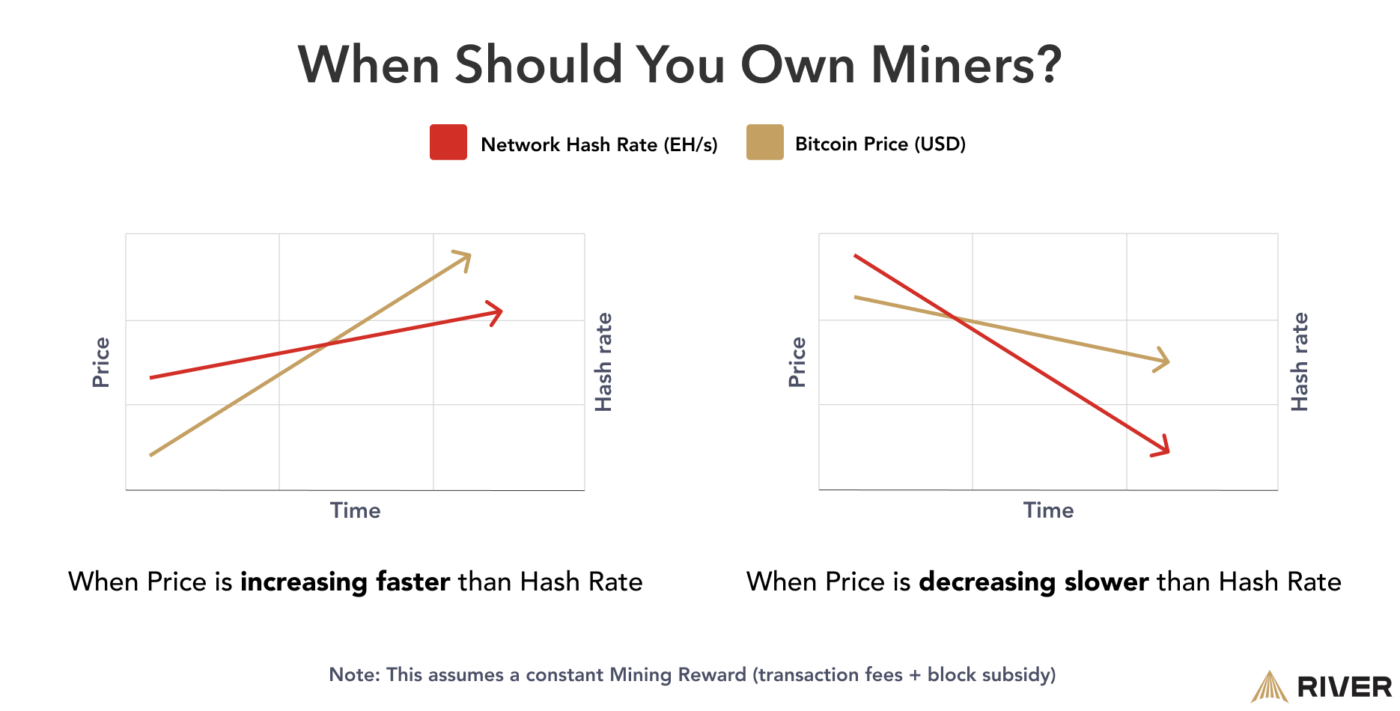

Should you buy Bitcoin or Bitcoin miners? Deciding between investing in Bitcoin miners or purchasing Bitcoin directly is a crucial decision that hinges on several key factors: your investment goals, risk tolerance, technical expertise, and available resources. If you believe that Bitcoin’s price will rise faster than the network’s hash rate over time, investing in Bitcoin miners could be more profitable. Conversely, if you’re skeptical of rapid price appreciation, buying Bitcoin outright might be the better option.

Benefits of Investing in Bitcoin Miners

Investing in Bitcoin miners allows you to potentially accumulate more Bitcoin than simply buying it at current market prices. This strategy effectively bets on the price of Bitcoin increasing at a faster pace than the network’s hash rate. By mining, you’re also contributing to the security and decentralization of the Bitcoin network, which is a critical component of its value proposition. Additionally, if Bitcoin’s price rises quickly or steadily over time, mining can help you recoup your initial investment and possibly even sell your hardware for a profit.

For a comprehensive guide on setting up your mining rig, check out our Step-by-Step Guide.

Should you buy Bitcoin or Bitcoin miners?

While investing in Bitcoin miners offers potential upsides, it also comes with complexities and risks. Mining profitability depends on various factors, including Bitcoin’s price, mining difficulty, block rewards, and transaction fees. Additionally, operational costs such as electricity, hardware maintenance, and physical infrastructure play a significant role in your returns. Unlike Bitcoin, which is highly liquid and can be sold instantly on exchanges, physical mining equipment can be harder to liquidate.

For beginners exploring cryptocurrency mining, our Beginner’s Guide to Cryptocurrency Mining provides a detailed overview of what to expect.

When Investing in Miners Was More Profitable

Historically, there have been periods when investing in Bitcoin miners was more profitable than owning Bitcoin. According to our analysis, owning miners was preferable to holding Bitcoin about 53% of the time from 2018 to the present. However, these trends are subject to change based on market conditions, making it crucial to stay informed and continuously evaluate your investment strategy.

To explore the top crypto mining devices for 2024, visit our Top 10 Crypto Mining Devices.

How to Get Started with Bitcoin Mining

If you’re considering an investment in Bitcoin mining, start by using mining profitability calculators to assess your potential returns. Tools like ASICMinerValue, Luxor’s profitability calculator, and Braiins’ calculator can help you understand the financial dynamics of mining. Comparing the results from different calculators can provide a more accurate picture of what to expect.

Conclusion

The decision to invest in Bitcoin or Bitcoin miners ultimately depends on your personal circumstances and market outlook. Consider all relevant factors, run the numbers, and cross-reference results with multiple tools to ensure you make the most informed choice.

Those who invest in Bitcoin miners often have a high degree of conviction in Bitcoin’s long-term success. If you believe that Bitcoin’s price will appreciate faster than the network’s hash rate, investing in miners could be the right move.

Key Takeaways:

- Consider investing in miners if you expect Bitcoin’s price to appreciate faster than the hash rate.

- This decision is complex and highly individualized; careful consideration and analysis are required.

- Since 2017, investing in miners has been preferable to owning only Bitcoin 53% of the time.