Guides

What Are Bitcoins and How Does It Work

What Are Bitcoins and How Does It Work, Bitcoin has become a buzzword in the financial world, often hailed as a revolutionary digital currency. But what exactly is Bitcoin, and how does it work? If you’re curious about “bit coin what is it” and seeking an in-depth understanding of how this cryptocurrency operates, you’re in the right place. This article will explore everything from Bitcoin’s origins to its functioning, mining process, and more.

What Is Bitcoin?

Bitcoin is a decentralized digital currency that allows for peer-to-peer transactions without the need for a central authority like a bank or government. It was introduced in 2008 by an anonymous figure or group known as Satoshi Nakamoto. Bitcoin operates on a network of computers (called nodes) that validate and record transactions in a public ledger called the blockchain. The beauty of Bitcoin lies in its ability to facilitate secure transactions without intermediaries, making it both an alternative to traditional currencies and an investment opportunity.

For those wondering, “how much was bit coin when it started?” Bitcoin was initially priced at virtually nothing. The first recorded transaction was in 2010 when 10,000 Bitcoins were exchanged for two pizzas, a sum that would be worth millions of dollars today.

How Does Bitcoin Work?

To explain Bitcoin and how it works, it’s essential to understand the blockchain technology that underpins it. The blockchain is a decentralized, distributed ledger that records all Bitcoin transactions. Each transaction is grouped into a block, and these blocks are chained together, making it nearly impossible to alter previous transactions.

Blocks and Blockchain

Each block in the blockchain contains:

- Transaction Data: Information about the transaction, including the sender, receiver, and amount of Bitcoin transferred.

- Previous Block’s Hash: A unique identifier for the previous block, ensuring the chain’s integrity.

- Nonce: A number used to generate the block’s hash, making it unique.

Once a block is complete, it’s added to the blockchain, creating a transparent and immutable record of all transactions.

What Does It Mean to Mine Bitcoin?

Mining is the process of validating Bitcoin transactions and adding them to the blockchain. Miners use specialized computers to solve complex mathematical problems. The first miner to solve the problem gets to add a new block to the blockchain and is rewarded with newly created Bitcoins. This process is essential for securing the network and maintaining its decentralized nature.

Mining isn’t just about solving problems; it’s also about competition. Miners race to solve these puzzles because the first one to do so receives a Bitcoin reward. Initially, this reward was 50 Bitcoins per block, but it undergoes a process called “halving” approximately every four years. Currently, the reward stands at 3.125 Bitcoins per block, following the latest halving in 2024.

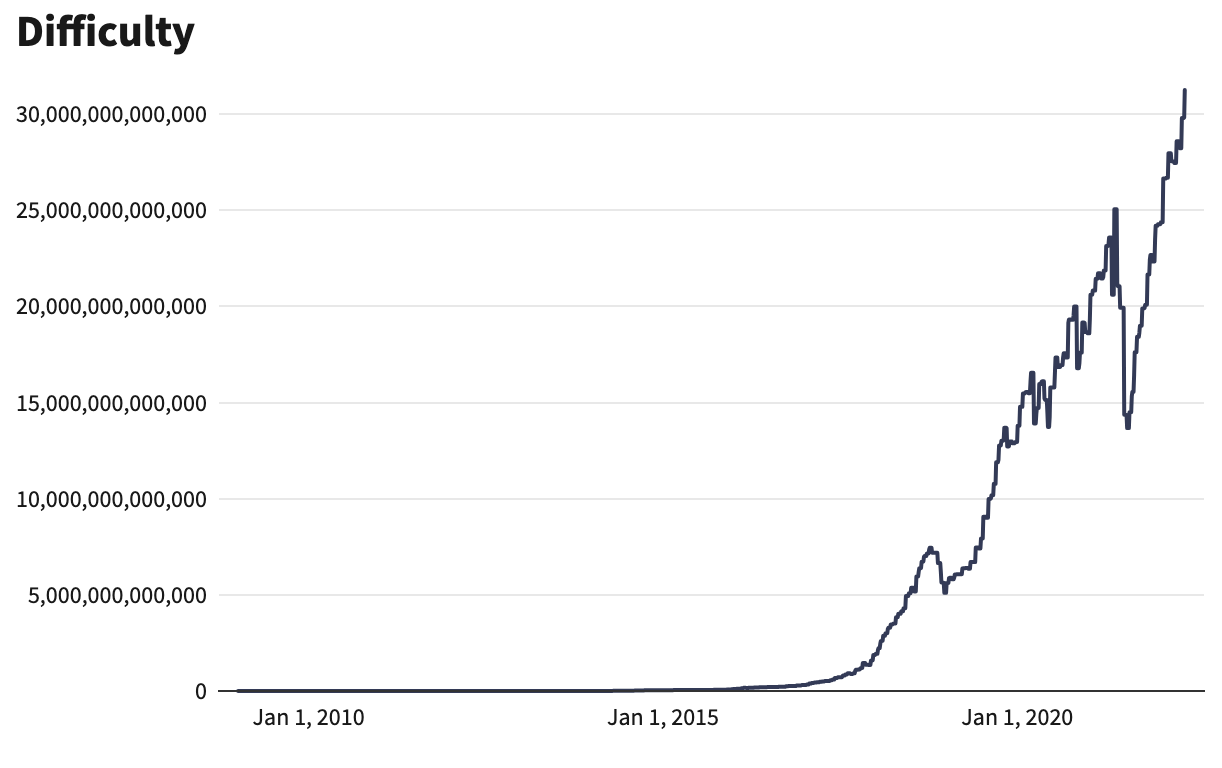

Mining Difficulty

As more miners join the network, the difficulty of mining increases. The network adjusts the difficulty every 2,016 blocks (approximately every two weeks) to ensure that a new block is added roughly every 10 minutes. This adjustment mechanism ensures the stable issuance of new Bitcoins.

If you’re thinking of getting into mining, it’s essential to note that it requires substantial computing power and energy. Many miners join mining pools to combine their resources and increase their chances of earning Bitcoin rewards.

Bitcoin Keys and Wallets

When you buy Bitcoin, it doesn’t physically exist; instead, it’s a digital token stored on the blockchain. You access your Bitcoin using a wallet, which is a software application that interacts with the blockchain.

- Public Key: This is like your bank account number. It’s used to receive Bitcoin.

- Private Key: This is like your PIN. It allows you to access and spend your Bitcoin.

Your wallet stores these keys and helps you manage your Bitcoin. There are two types of wallets:

- Custodial Wallets: Where a third party holds your keys for you, similar to how a bank holds your money.

- Non-Custodial Wallets: Where you have complete control over your keys, providing more security but also more responsibility.

For added security, many Bitcoin holders use cold storage, which keeps their private keys offline and out of reach of hackers.

How Bitcoin Transactions Work

Bitcoin transactions are relatively straightforward. When you want to send Bitcoin, you enter the recipient’s public key (address) in your wallet, authorize the transaction with your private key, and pay a transaction fee to incentivize miners to process it. The transaction then enters the mempool, where it waits to be included in the next block.

The transaction is only complete once a miner validates it by adding it to a block. This process can take a few minutes to several hours, depending on the network’s congestion.

The Pros and Cons of Investing in Bitcoin

Like any investment, Bitcoin comes with its pros and cons.

Pros:

- High Growth Potential: Bitcoin has shown significant growth since its inception, creating immense wealth for early adopters.

- Liquidity: With a market cap of over $1 trillion and a 24-hour trading volume of billions, Bitcoin is highly liquid.

- Inflation Hedge: Many investors view Bitcoin as a hedge against inflation, given its limited supply of 21 million coins.

Cons:

- Volatility: Bitcoin’s price can swing wildly, making it a risky investment.

- High Fees: Transaction fees can vary, sometimes reaching exorbitant levels during periods of high demand.

- Security Risks: While the Bitcoin blockchain is secure, wallets and exchanges can be vulnerable to hacks.

Conclusion

Bitcoin is a groundbreaking digital currency that offers a decentralized way to transfer and store value. Understanding “what are bitcoins and how does it work” is crucial for anyone looking to invest or use this innovative technology. While it presents a unique investment opportunity, it also comes with risks that must be carefully considered.

If you’re interested in learning more about cryptocurrency, you may find our guide on the best crypto to buy now helpful. Additionally, if you’re contemplating whether to buy Bitcoin or Bitcoin miners, check out this article here. Finally, if you’re wondering how to buy Bitcoin with Venmo, we have a detailed guide here.

For more information on Bitcoin, you can also refer to the Wikipedia page on Bitcoin.